Quick Wiki

- Full Name John Pierpont Morgan

- Birth Date April 17, 1837

- Death Date 1913-03-31

- Age At Death 75

- Place Of Death Rome, Lazio, Kingdom of Italy

- Nationality American

- Birthplace Hartford, Connecticut

- Occupation Financier, Investment banker, Accountant, Art collector

- Mother Juliet Pierpont

- Father Junius Spencer Morgan

- Siblings Sarah Spencer Morgan, Mary Lyman Morgan, Juliet Pierpont Morgan, Junius Spencer Morgan, Jr.

- Father's Occupation Banker and Financier

- Education University of Göttingen

- Spouses Amelia Sturges, Frances Louise Tracy

- Children J. P. Morgan Jr., Anne Morgan, Louisa Pierpont Morgan, Juliet Pierpont Morgan

- Grandfather Joseph Morgan

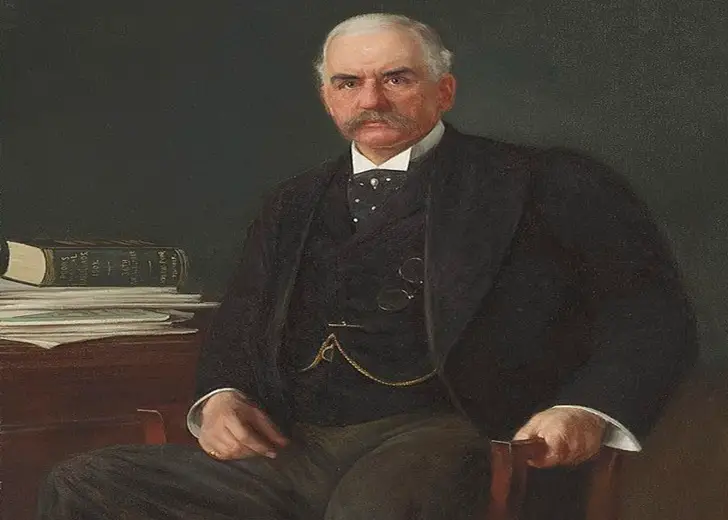

J.P. Morgan | Biography

J.P. Morgan was a revolutionary figure in finance, known for founding J.P. Morgan & Co. and shaping the American railroad industry, leaving behind an enduring legacy.

Who is J.P. Morgan?

J.P. Morgan, born John Pierpont Morgan on April 17, 1837, in Hartford, Connecticut, was a towering figure in American finance known for his profound influence on the banking industry and corporate mergers. After receiving a robust education overseas, he embarked on his career in finance in the late 1850s. Morgan co-founded J.P. Morgan & Co. in 1871 and quickly gained prominence in the railroad sector, facilitating significant transactions that shaped the industry. His strategic acumen propelled him to become a key player in corporate America, overseeing the creation of massive enterprises like U.S. Steel, the first billion-dollar corporation.

Morgan's financial prowess extended beyond corporate expansion; he played a vital role in stabilizing the U.S. economy during times of crisis, notably bailing out the U.S. Treasury in 1895 and again during the financial panic of 1907. His actions earned him both admirers and critics, as his ability to influence government financial policies raised questions about the power of Wall Street financiers. Despite the controversies, Morgan's legacy includes not just his contributions to American banking and corporate structure but also a remarkable art collection, much of which is housed in the Morgan Library & Museum, ensuring his impact endures.

Early Life and Education

John Pierpont Morgan was born on April 17, 1837, in Hartford, Connecticut, into a prominent New England family. His grandfather, Joseph Morgan, was a founder of Aetna Insurance Company, and his father, Junius Morgan, was a successful businessman. From an early age, Pierpont, often called "Jack," was a sickly child, dealing with recurrent seizures and other health issues, which led to prolonged periods of time spent at home. However, during his healthier moments, he was heavily influenced by a cultural environment that included art galleries and concerts, ultimately igniting his lifelong passion for the arts.

In 1854, the Morgan family relocated to London, where Junius Morgan became a partner in the banking firm George Peabody & Co. This move catalyzed Pierpont's education, as he was sent to the Institute Sillig in Switzerland, where he mastered French and demonstrated impressive mathematical skills. His academic journey continued at Göttingen University in Germany, where he further honed his educational background. Upon returning to the United States in 1857, J.P. Morgan embarked on his professional career in the financial sector, illustrating the foundational experiences that shaped his future success in banking and finance.

Early Career and Marriages

After completing his education in 1857, J.P. Morgan moved to New York City to work as a clerk at Duncan, Sherman & Co., the American branch of his father's banking firm. His early career showcased his financial acumen; during a business trip to New Orleans, he cleverly purchased a surplus of coffee from a ship captain and resold it to local merchants for a significant profit. This success encouraged him to establish his own banking practice, and in the early 1860s, he founded J. Pierpont Morgan & Co., while still collaborating closely with his father on essential transactions.

Morgan's personal life experienced both joy and heartbreak during this period. He married Amelia "Memie" Sturges in 1861, but tragically, she passed away from tuberculosis shortly after their wedding. This loss deeply affected him and led him to focus intensively on his work. In 1865, he found love again with Frances Louisa "Fanny" Tracy, whom he married and with whom he had four children. Their family provided a supportive backdrop as Morgan ascended to prominence in the banking industry, setting the stage for his significant career achievements in the decades to follow.

Railroad Magnate

J.P. Morgan emerged as a formidable force in the railroad industry during the late 19th century, redefining the landscape of American finance. In 1871, he partnered with Philadelphia banker Anthony Drexel to establish Drexel, Morgan & Co., rapidly gaining a reputation for his astute financial acumen. His pivotal moment came in 1879 when he successfully executed the sale of 250,000 shares of stock in the New York Central Railroad, solidifying his position on its board. Morgan’s ability to handle substantial transactions without disrupting market prices underscored his influence and allowed him to expand his role in the industry.

Morgan's prowess in railroad consolidation was exemplified by the famous Corsair Compact in 1885, during which he mediated the disputes between feuding railroad executives aboard his yacht. Through strategic negotiations and an unwavering assertiveness, he established a course for stability in the industry. Further, he orchestrated significant mergers and capital financing deals, culminating in his role in forming the Northern Securities Company in 1901, which allowed him to control a substantial portion of the country's railroads. His methods and mergers would lay the groundwork for the modern corporate landscape throughout the United States.

Financial Empire and Government Savior

J.P. Morgan's influence grew significantly in the financial landscape following the death of his father in 1890. He skillfully orchestrated the merger of Edison General Electric and Thomson-Houston Company in 1892, forming General Electric, which showcased his prowess in corporate consolidation. Morgan’s fascination for the arts also flourished during this time, as he began expanding a remarkable art collection that would later become one of his lasting legacies. His financial acumen was further highlighted during the Panic of 1893 when he formed a syndicate of international investors to supply gold to the U.S. Treasury, stabilizing the economy when it was most vulnerable.

In 1901, Morgan partnered with James J. Hill to create the Northern Securities Company, gaining control of roughly one-third of America’s railways. However, his dominance caught the attention of President Theodore Roosevelt, leading to a significant legal challenge under the Sherman Antitrust Act. The Supreme Court ultimately sided with the government in 1904, demonstrating the tension between Morgan's financial empire and regulatory forces. Despite this setback, he continued to wield immense power, acting as a critical fiscal agent during the formation of Panama and intervening in the 1907 financial panic by negotiating a bailout for failing banks, solidifying his role as a stabilizing force in the U.S. economy.

Presidential Foe and Ally

In the early 1900s, J.P. Morgan’s influence reached unprecedented heights, particularly with the formation of the Northern Securities Company in 1901. This company held majority shares in critical railroads, granting Morgan control over roughly one-third of the nation’s railway network. However, it wasn't long before his dominance in the financial and railway sectors drew the ire of President Theodore Roosevelt, who considered Morgan and his contemporaries the so-called "robber barons" of Wall Street. This conflict culminated in the Justice Department's legal charge against Northern Securities for violating the Sherman Antitrust Act, leading to a landmark Supreme Court ruling in favor of the government in 1904.

Despite this legal setback, Morgan continued to play a pivotal role in both the industry and government affairs. In 1903, he was appointed as the fiscal agent for Panama, overseeing the management of significant funds related to the New Panama Canal Company. Furthermore, when the nation faced economic turmoil during the Panic of 1907, it was Morgan's leadership that galvanized the banking community to stabilize the faltering financial system. By orchestrating crisis meetings in his Manhattan library, he negotiated a bailout agreement that was crucial in restoring confidence in the banking sector, exemplifying his dual role as both a financial magnate and a governmental ally.

Death and Legacy

J.P. Morgan passed away on March 31, 1913, in Rome, Italy, after a voyage marked by declining health. His death was significant enough that the New York Stock Exchange closed until noon to honor his memory. Morgan’s influence was profound, having transformed the financial landscape of the United States and shaped the very nature of banking itself. His adept maneuvering during financial crises — such as his bailouts of the U.S. Treasury in 1895 and 1907 — demonstrated his critical role in stabilizing the economy, albeit raising concerns about the power concentrated in the hands of a few individuals.

Morgan's legacy extends beyond finance; he was a passionate art collector, amassing a remarkable collection that was rivaled by few. His ornate library, specifically built to house these treasures, includes works of extraordinary importance. After his death, his son, Jack Morgan, ensured the private collection was made accessible to the public with the establishment of the Morgan Library & Museum in the 1920s. This institution, alongside JPMorgan Chase & Co., which continues to thrive into the 21st century, serves as a testament to Morgan's extensive impact on both the banking industry and the arts.

Personal Life: Wife and Children

J.P. Morgan's personal life was marked by two significant marriages and the legacy of his children. In 1861, he married Amelia "Memie" Sturges, the daughter of a prosperous merchant. Their marriage was short-lived, as Amelia battled tuberculosis and passed away in 1862, leaving Morgan heartbroken. Following this tragedy, he immersed himself in his work, which catalyzed his ascent in the banking world. He later found love again and married Frances Louisa "Fanny" Tracy in 1865. Together, they had four children: John Pierpont "Jack" Morgan Jr., who would eventually take over his father's business, and three daughters who played various roles in society, contributing to the family's prominence.

Morgan's family life was intertwined with his professional undertakings, as wealth and power shaped their upbringing. The Morgans resided in lavish residences, reflecting their status, and J.P. often highlighted the importance of education and culture. His children were exposed to the arts from an early age, fostering an appreciation that mirrored their father's passions. Additionally, Morgan's son Jack would later blend these influences into his own leadership style, guided by the values imparted by J.P. Morgan throughout his life. This rich family legacy was complemented by a significant art collection that J.P. bequeathed to posterity, solidifying the family's influence in both business and culture.

Net Worth and Earning: Salary

J.P. Morgan, one of the most influential figures in American finance, was a man of extraordinary wealth and power. By the time of his death in 1913, his net worth was estimated to be around $68 million, a staggering sum equivalent to over a billion dollars today when adjusted for inflation. His wealth primarily stemmed from his successful banking career and significant ownership stakes in various companies, including U.S. Steel and General Electric. Morgan's strategic decisions in consolidating industries and managing major transactions helped establish him as a premier financier, earning him a place among America's wealthiest individuals of his time.

Morgan's earnings were not only tied to his banking activities; he was involved in many lucrative business endeavors. His firm, J.P. Morgan & Co., played pivotal roles in critical mergers and acquisitions, particularly in the railroad and steel industries, which generated immense profits. Furthermore, he was known for his ability to negotiate sizeable loans and bailouts for both private companies and the federal government during financial crises, earning lucrative fees for his services. His financial acumen and authoritative presence allowed him to command substantial salaries and profits throughout his career, solidifying his legacy as a titan of American capitalism.

FAQs

Who was J.P. Morgan?

J.P. Morgan, born John Pierpont Morgan in 1837, was a dominant figure in American finance and banking. He co-founded J.P. Morgan & Co. in 1871, and became a key player in the railroad industry and later the steel sector, notably creating U.S. Steel. Morgan leveraged his influence to stabilize the U.S. economy during financial crises and is remembered for his vast wealth and art collection.

What contributions did J.P. Morgan make to the banking industry?

Morgan redefined the banking industry by facilitating the establishment of major corporations, including General Electric and U.S. Steel. His innovative financing techniques, such as syndicate formation and corporate mergers, allowed for unprecedented growth within industries. He also played a critical role in managing economic downturns by coordinating bailouts for the U.S. Treasury.

How did J.P. Morgan influence the railroad industry?

Morgan's influence on the railroad industry began when he successfully negotiated major stock transactions and formed key partnerships, like the Corsair Compact to mediate disputes between railroad executives. His strategic financing efforts led to large-scale consolidations that shaped the landscape of American railroads, ultimately allowing him to control significant market shares.

What impact did J.P. Morgan have on labor relations?

J.P. Morgan's business practices often came under criticism for concentrating wealth among a few individuals and corporations, leading to conflicts with labor unions. His dealings influenced the rise of populism and legislative measures aimed at regulating monopolies. This resulted in increased scrutiny and tensions between corporate interests and labor rights.

What was J.P. Morgan's relationship with the U.S. government?

Morgan had a complex relationship with the U.S. government, serving as both a consultant and financier during critical economic moments. His intervention during the Panic of 1893 and again in 1907 exemplified his role in stabilizing the economy, yet his influence raised concerns about the power of private banks and ultimately contributed to the establishment of the Federal Reserve.

What legacy did J.P. Morgan leave behind?

Morgan's legacy endures through the financial institution he founded, JPMorgan Chase & Co., which remains one of the largest banking firms today. Additionally, his extensive art collection, housed in the Morgan Library & Museum, reflects his passion for the arts. His life and career also prompted discussions around corporate ethics and federal monetary policy.